California Cannabis Tax Crisis!

By: Kimberly Calderon

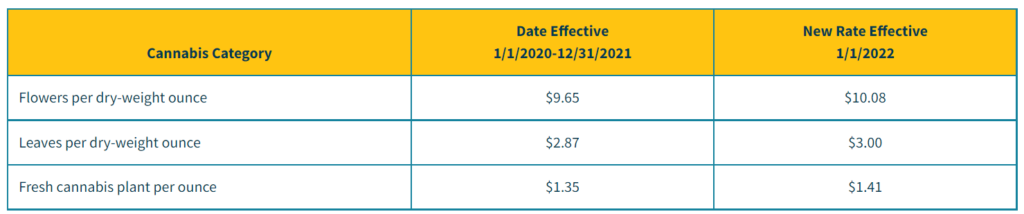

As of January 1st, 2022 the state of California increased its cannabis cultivation tax to $10.60 per ounce which equates to roughly $160 per pound of cannabis. What does this mean for the future of the cannabis industry and how can it be affected by this rise in tax?

https://www.cdtfa.ca.gov/industry/cannabis.htm

Cultivation taxes are being increased by about 5%, which means that “Farmers are expected to pay more than $166 million in cultivation taxes this year. An extra 4.5% means they’ll pay another $7.5 million in 2022.” (Brooke Staggs 2021). This will cause a rise in cannabis prices which will affect the cannabis farms because they will have to raise their prices in order to have the proper funds to deal with the high amount they will be subjected to pay in taxes. This will also promote the success of illegal growth because it will be more cost-efficient for buyers who do not have the money for the new prices that are going to keep rising throughout the year.

According to Cal Matters, “This is devastating for farmers, but they’re not the only ones who are hurting. Cannabis workers across the industry are impacted. Hundreds of jobs have been lost due to excessively high taxes and even more, will disappear in the coming year as companies are forced to further cut costs, reduce operations or go out of business altogether.” (CalMatters 2022). The effects of this tax increase will continue to be seen throughout this year and the years to come because of Governor Gavin Newsoms’ failure with Proposition 64 which has caused this tax increase. The true question now is, what can be done to help struggling farmers, and how long will it take for change to be seen?

Work Cited (Articles used as reference):

California Department of Tax and Fee Administration. “Tax Guide for Cannabis Businesses.” Tax Guide for Cannabis Businesses, https://www.cdtfa.ca.gov/industry/cannabis.htm.

Commentary, Guest. “Fix California’s Cannabis Framework; Eliminate the Cultivation Tax.” CalMatters, 13 Dec. 2021, https://calmatters.org/commentary/2021/12/fix-californias-cannabis-framework-eliminate-the-cultivation-tax/.

John Schroyer, Chief Correspondent, and John Schroyer. “California Recreational Marijuana in Crisis after Two Years.” MJBizDaily, 18 Dec. 2021, https://mjbizdaily.com/california-recreational-marijuana-in-crisis-after-two-years/.

Staggs, Brooke. “With Taxes Going up, Cannabis Operators Threaten ‘California Weed Party’.” The Mercury News, The Mercury News, 4 Dec. 2021, https://www.mercurynews.com/2021/12/04/with-taxes-going-up-cannabis-operators-threaten-weed-party/#:~:text=The%20 markup%20rate%20will%20 hold,prices%20to%20crater%20in%20California.